Everything about the Letter of Credit (L/C)

Looking for enhanced security for your international shipments and payments? Want to establish clear agreements about specific risks of international transactions? Aiming for a watertight guarantee of payment for your delivered goods or services?

In all these cases, the Letter of Credit (abbreviated L/C) is an international means of payment that can strengthen your business transactions and increase your security. We can take care of almost all actions related to a Letter of Credit. Therefore, limit your risks and focus on the things you really want to deal with.

Marloes Wittebroek,

owner Elceco

Letter of Credit meaning

What does the term ‘Letter of Credit’ mean? A Letter of Credit, also known as L/C or documentary credit, is a financial instrument used in international trade.

In these transactions, an L/C serves as a guarantee of payment for both the buyer and the seller, with the buyer’s bank confirming their payment obligation. Essentially, it means that the buyer’s bank undertakes to pay the seller, provided the seller meets the predetermined conditions and documentation specified in the Letter of Credit.

The target

What is the purpose of a Letter of Credit?

- For the selling party: reducing payment risk. By meeting the established credit conditions, the seller obtains security of payment from a bank. Confirming the L/C by the seller’s advising bank will further strengthen this certainty;

- For the purchasing party: reducing the risk of delivery problems. By specifying relevant documents in the L/C, the buyer can demonstrate that the seller actually delivers in accordance with the agreement.

The different types

What types of Letters of Credit do we use?

- The “regular” L/C: This documentary L/C is the most common type we see;

- Transferable L/C: the use of this variant offers the beneficiary of the L/C the opportunity to add a second beneficiary;

- Back-to-back L/C: this involves two L/Cs that are used together to finance a (trade) transaction;

- Standby L/C: this is very similar to the security used in a bank guarantee.

“Elceco is a very customer oriented company adapting itself to the needs, internal procedures and capabilities of its customers.

They have an outstanding, practical knowledge on L/C’s over the whole world. They have been a major contributor to the successful & risk covered development of our export to Africa.

Komatsu about the collaboration with Elceco

The use

A Letter of Credit is a valuable tool in international trade, used in various situations. Below is a list of situations in which a Letter of Credit can be beneficial:

- International trade transactions: when buying and selling goods across national borders, a Letter of Credit provides security to both the buyer and the seller;

- Reducing Risk: when there are political or financial risks associated with a transaction, a Letter of Credit can offer protection;

- New trading partners: when entering into transactions with new partners, where trust is still being built, a Letter of Credit can provide a basis for trust;

- Large orders or custom-made products: in case of large or custom-made products, a Letter of Credit can offer certainty of payment for the seller, even if unforeseen problems arise;

- When Advance Payment is Required: in cases where the seller requires advance payment, a Letter of Credit can protect the buyer by ensuring payment is made once the agreed terms are fulfilled;

- Complex transactions: for complex transactions with specific payment terms, a Letter of Credit can act as a legally binding document, especially for phased delivery of services and phased payments;

- Export financing: when obtaining financing for export transactions, a Letter of Credit can serve as a guarantee for the financing institution;

- Meeting strict delivery and performance requirements: where strict adherence to delivery or performance criteria is essential, a Letter of Credit can enforce these conditions.

In all these cases, a Letter of Credit offers a structured and reliable method to safeguard the interests of both the buyer and the seller and to reduce risks in international trade transactions.

The advantages

A Letter of Credit (L/C) offers a range of benefits for both buyers and sellers in international trade transactions.

Benefits for the Seller:

- Increased payment security: The buyer’s bank guarantees payment once the seller fulfills the agreed-upon conditions;

- Reduced risk: Payment is linked to the fulfillment of specific conditions, such as proper documentation and delivery of goods;

- More financial flexibility: The L/C can serve as collateral with a bank, providing the seller with access to financing;

- Protection against currency risks: Payment is made in the currency of the L/C, insulating the seller from exchange rate fluctuations;

- Can serve as pre-financing: The L/C allows the seller to access funds before the goods or services are delivered;

- Enhanced confidentiality: Communications and documentation between banks and parties involved are often treated confidentially.

Benefits for Both Buyer and Seller:

- Strengthens trust internationally: the L/C provides a reliable payment guarantee, especially when dealing with new or unknown partners;

- Facilitates transactions even when the buyer’s creditworthiness is uncertain;

- Ensures compliance with terms: payment is contingent upon the correct submission of specific documentation, guaranteeing adherence to agreed-upon terms;

- Suitable for complex transactions: the L/C can effectively handle complex transactions with detailed payment terms and stages.

In conclusion, a Letter of Credit serves as a valuable tool not only for mitigating risks and ensuring secure transactions, but also for facilitating and promoting international trade.

“Berg Hortimotive uses L/Cs as an international payment method. Elceco’s team provides excellent support sharing their expertise advice and responding quickly and effectively to any questions we might have. We are extremely happy with their service.“

Berg Hortimotive about the collaboration with Elceco

The cons

Although Letters of Credit (L/C) offer many benefits in terms of payment security and risk management, there are also some disadvantages to using them:

- Complexity and administrative burden: preparing and processing the required documentation for a Letter of Credit can be complex and lead to a significant administrative burden for both buyer and seller. As a Letter of Credit specialist, we can help you with this. Read more about us or read what customers say about us;

- Documents in a Letter of Credit may contain errors, including:

-

- Errors: Typographical mistakes or incorrect formatting;

- Lack of clarity: Unclear instructions or ambiguous language;

- Difficulties fulfilling requirements: Seller’s inability to meet the stipulated conditions;

- Miscommunication between parties: Incorrect or incomplete instructions to third parties involved in the transaction.

-

- These errors can lead to delays in payments, increased costs, and even disputes. Therefore, it’s crucial for all parties involved to carefully review documentation and ensure clear communication throughout the process. This revision provides a more professional and informative presentation of the potential issues while maintaining clarity and avoiding negativity towards any specific party.

- Additional costs: the use of Letters of Credit entails costs, especially at banks, including issuing costs, documentary costs and any change costs;

- Potential delays: the process of document verification and approval may result in delays in payment, especially if there are problems or inconsistencies with the submitted documentation;

- L/Cs can be less flexible: making changes to the transaction terms after the L/C is issued can be complex and incur additional costs, potentially causing delays;

- Unconfirmed L/Cs carry credit risk: if the L/C is not confirmed by a second bank, payment remains dependent on the creditworthiness of the buyer’s bank, introducing an element of financial risk;

- L/Cs do not guarantee quality: while an L/C ensures the financial aspects of the transaction, it does not guarantee the quality of the goods or services provided. To mitigate this, you can request the inclusion of an inspection/quality certificate in the documentation, allowing an independent third party to verify the quality.

However, companies should carefully assess whether the L/C’s security benefits outweigh its drawbacks based on their specific business needs.

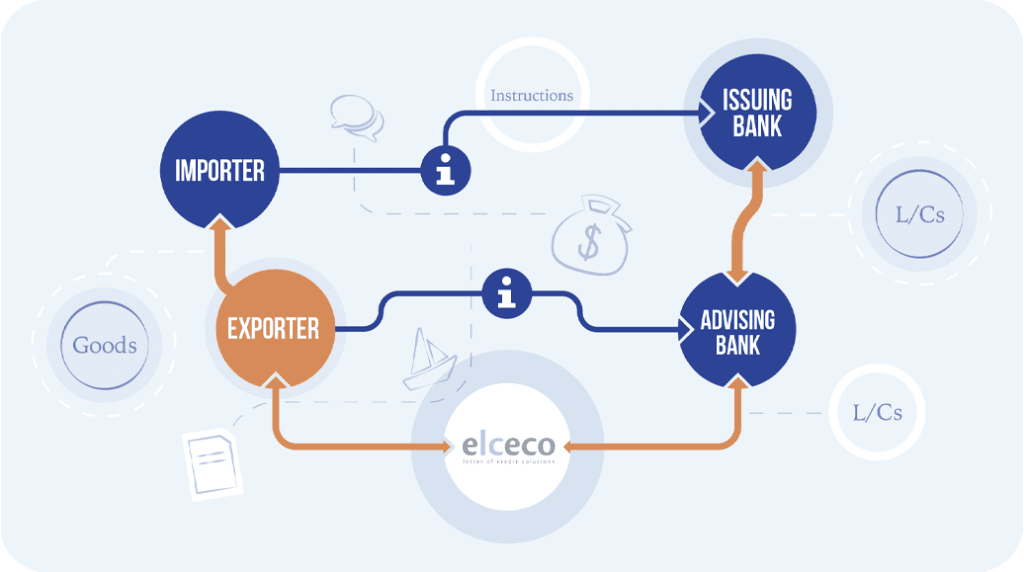

The involved parties

The following parties are involved in a Letter of Credit:

- Importer (as buyer); the importer is mainly located in regions such as the Middle East, Far East and Africa. The buyer initiates the L/C process by going to his bank with the request to open an L/C. The buyer undertakes to have the money from the transaction tied up with his bank, so that it is available to the seller;

- Exporter (as seller); the exporter must work with the buyer to agree on an L/C that is workable for both parties. This is usually a short summary of the sales contract in which the most important points are stated that must be carried out by the selling and/or purchasing party, depending on the L/C. The buyer and seller regularly agree on a draft L/C together before the buyer takes it to his bank. This often saves both parties a lot of time and money prior to the L/C process at the banks and possible issues are identified in a timely manner;

- The opening bank (on behalf of the importer); this is the buyer’s bank and the word basically says it all. They open an L/C in favor of the selling party, the exporter. They block the amount of the transaction from the purchasing party. They send a message to the selling party’s bank via SWIFT to take the process to the next step;

- The advising bank (on behalf of the exporter): this is the seller’s bank. They receive the SWIFT message from the opening bank and view the L/C from the financial point of view. They inform the seller by sending them the L/C, together with a preliminary letter in which they indicate additional aspects relating to the possibilities or possible risks of these transactions. Consider, for example, sanctions policy and money laundering.

“Over the years Meteor Systems have been completely satisfied with Elceco’s services.

Elceco liaises and thinks with us, gives good advice and is very approachable. Whoever you speak to, the service is always competent, efficient and helpful. We thoroughly recommend Elceco to any company in need of support with LC transactions.“

Meteor Systems about the collaboration with Elceco

Content

What does a Letter of Credit say? A Letter of Credit clearly states which product is delivered by whom, when and how the transport takes place. It also describes who bears what responsibilities.

Documents

Which documents are part of the Letter of Credit? The following documents could be part of the Letter of Credit:

- An invoice;

- A packing list;

- A transport document;

- A Certificate of Origin;

- An insurance certificate;

- An inspection certificate.

The handling

Processing a Letter of Credit involves several steps and the parties involved include the buyer, the seller, the opening bank (on behalf of the buyer), the advising bank (on behalf of the exporter) and sometimes the confirmation bank (optional). Below are the general steps when handling a Letter of Credit:

- Step 1: the importer goes to his bank to have a Letter of Credit drawn up in favor of the exporter;

- Step 2: the importer’s bank fixes an L/C amount (credit opening) under specific conditions;

- Step 3: the issuing bank then sends the Letter of Credit to the advising bank. The banks use the international means of communication SWIFT for this;

- Step 4: the exporter’s bank checks the Letter of Credit. If approved, he sends this to the exporter with an advisory letter. This completes the process at the bank;

- Step 5: the documents must meet the LC conditions in order to obtain an irrevocable commitment to payment;

- Step 6: if the conditions are met and approved by both banks, the payment by the exporter becomes final.

Infographic

The handling of a Letter of Credit is shown in an infographic below:

Costs

What does a Letter of Credit cost? The cost of a Letter of Credit depends on the following factors:

- The bank’s risk;

- The risk of the country to which the export is taking place;

- The amount of the Letter of Credit itself;

- The lead time of the Letter of Credit.

The history

The history of the use of Letters of Credit is significant and is characterized by the wide possibilities arising from internationally recognized rules and procedures.

The International Chamber of Commerce (ICC) played a pioneering role by establishing the first regulations in the early 1930s and combining them into the first Uniform Customs and Practice for Documentary Credits (UCP). Through this initiative, commercial banks created a voluntary framework to apply these rules in transactions worldwide.

In the early 1970s, SWIFT (Society for Worldwide Interbank Financial Telecommunication) was founded, allowing financial institutions to exchange data electronically and improving cost control. This international communication system between financial institutions provided an efficient way to facilitate transactions and contribute to the further development of international trade practices.

The common thread over the years has remained consistent: international business involving at least four parties, including the buyer, seller, opening bank and advising bank. Changes are especially visible in the receipt of Letters of Credit (L/C) and the processing and presentation of associated documents. In the beginning these were sent physically or via telex, nowadays this is done by e-mail, via integrated systems with the bank, and sometimes still in the classic way by post.

Thanks to advancing computerization, global communication is becoming faster and more efficient, allowing processes to run faster than before. Buyers and sellers can now communicate quickly via email or telephone, which has significantly increased the dynamics of international transactions.

Contact with us

Do you have a question about our work or do you want more information about Letters of Credit? Please fill in the contact form. Or contact us via our details below.

We think it is important to be easily accessible. Questions or doubts about something? Or do you just want to discuss something? Feel free to contact us by phone.

Telephone: +31 (0)413 353 131

E-mail address: info@elceco.com

We usually respond within two working days.

Address:

Hoogstraat 5

5462 CW Veghel

The Netherlands

Openings hours:

Monday to Friday from 08.30 to 17.00.

Closed on Saturday and Sunday.

Make an appointment?

Do you have a question about handling Letters of Credit? Or would you like to know how we can help you? Please feel free to contact us by completing the contact form below. We usually respond within two working days.