Letter of Credit (L/C)

Doing business without worries

Doing business abroad or with foreign companies? Processing an export order and delivering the goods is not, in itself, a guarantee of success. This process is only complete when the payment has actually been received.

As L/C specialists, we can take care of your Letters of Credit with a great deal of knowledge.

Minimal risks

An L/C offers maximum security for you as an exporter. We can take almost all of the responsibilities of a Letter of Credit off your hands. This way, you keep your L/C risks to a minimum and you can continue with the things you really want to be focusing on: selling your products or services.

Looking for enhanced security for your international shipments and payments? Want to establish clear agreements about specific risks of international transactions? Aiming for a watertight guarantee of payment for your delivered goods or services?

Increase your certainty

In all these cases, the Letter of Credit (abbreviated L/C) is an international means of payment that can strengthen your business transactions and increase your security. We can take care of almost all actions related to a Letter of Credit. Therefore, limit your risks and focus on the things you really want to deal with.

Marloes Wittebroek,

owner Elceco

Letter of Credit meaning

What does the term ‘Letter of Credit’ mean? A Letter of Credit, also known as L/C or documentary credit, is a financial instrument used in international trade.

In these transactions, an L/C serves as a guarantee of payment for both the buyer and the seller, with the buyer’s bank confirming their payment obligation. Essentially, it means that the buyer’s bank undertakes to pay the seller, provided the seller meets the predetermined conditions and documentation specified in the Letter of Credit.

The target

What is the purpose of a Letter of Credit?

- For the selling party: reducing payment risk. By meeting the established credit conditions, the seller obtains security of payment from a bank. Confirming the L/C by the seller’s advising bank will further strengthen this certainty;

- For the purchasing party: reducing the risk of delivery problems. By specifying relevant documents in the L/C, the buyer can demonstrate that the seller actually delivers in accordance with the agreement.

The different types

What types of Letters of Credit are there? Although the regular L/C forms the basis, various types exist that are designed for specific trade situations. Choosing the right type is essential for a smooth transaction. Below, we explain the most common types.

- The irrevocable L/C: this is the most commonly used form and is often seen as the ‘regular’ L/C. Once this L/C is opened, its terms cannot be changed or cancelled without the agreement of all parties involved (buyer, seller, and the banks). This offers the seller strong payment security;

- The transferable L/C: this variant is ideal for intermediaries who do not produce the goods themselves. The first beneficiary (the intermediary) has the right to transfer the L/C in whole or in part to the actual supplier (the second beneficiary). We do not see this variant very often, partly because banks are also hesitant about it;

- Practical example: a Dutch trading house sells machines to a customer in Egypt. The trading house buys these machines from a German manufacturer. The Egyptian customer opens a transferable L/C in favour of the trading house. The trading house then transfers part of this L/C to the German manufacturer. This gives the manufacturer the security that they will be paid after delivering the machines to the trading house.

- The back-to-back L/C: this is an alternative to the transferable L/C and is also often used by intermediaries. In this construction, two separate L/Cs are set up. The first L/C (from the end buyer to the intermediary) serves as collateral for the second L/C (from the intermediary to the end producer). With this variant, you must be very careful to keep the details completely separate in terms of amounts and parties;

- Practical example: a Dutch importer sells goods to a customer in Brazil and opens L/C 1 (‘master L/C’) for this purpose. However, the goods are produced in China. The Dutch importer uses L/C 1 as collateral at their own bank to open a second L/C (L/C 2, the ‘back L/C’) for the Chinese manufacturer. This way, all parties in the chain are assured of payment.

- The standby L/C: this type of L/C functions more like a bank guarantee than a direct payment method. It is a safety net. The seller will only draw on the standby L/C if the buyer fails to meet their contractual payment obligations. So, where a regular L/C is used to make a payment, a standby L/C is used when a payment is missed;

- The revolving L/C: this variant is perfect for long-term contracts with regular, recurring shipments of the same goods. Instead of opening a new L/C for each separate shipment, the amount of this L/C is automatically ‘replenished’ after each successful transaction. This saves considerably on administration and costs. We no longer see this variant in practice. This is partly because many companies simply find the amounts too high.

We primarily see the irrevocable L/C; this is the most commonly used form and is often seen as the ‘regular’ L/C.

“Elceco is a very customer oriented company adapting itself to the needs, internal procedures and capabilities of its customers.

They have an outstanding, practical knowledge on L/C’s over the whole world. They have been a major contributor to the successful & risk covered development of our export to Africa.

Komatsu about the collaboration with Elceco

The use

A Letter of Credit is a valuable tool in international trade, used in various situations. Below is a list of situations in which a Letter of Credit can be beneficial:

- International trade transactions: when buying and selling goods across national borders, a Letter of Credit provides security to both the buyer and the seller;

- Reducing Risk: when there are political or financial risks associated with a transaction, a Letter of Credit can offer protection;

- New trading partners: when entering into transactions with new partners, where trust is still being built, a Letter of Credit can provide a basis for trust;

- Large orders or custom-made products: in case of large or custom-made products, a Letter of Credit can offer certainty of payment for the seller, even if unforeseen problems arise;

- When Advance Payment is Required: in cases where the seller requires advance payment, a Letter of Credit can protect the buyer by ensuring payment is made once the agreed terms are fulfilled;

- Complex transactions: for complex transactions with specific payment terms, a Letter of Credit can act as a legally binding document, especially for phased delivery of services and phased payments;

- Export financing: when obtaining financing for export transactions, a Letter of Credit can serve as a guarantee for the financing institution;

- Meeting strict delivery and performance requirements: where strict adherence to delivery or performance criteria is essential, a Letter of Credit can enforce these conditions.

In all these cases, a Letter of Credit offers a structured and reliable method to safeguard the interests of both the buyer and the seller and to reduce risks in international trade transactions.

The advantages

A Letter of Credit (L/C) offers a range of benefits for both buyers and sellers in international trade transactions.

Benefits for the Seller:

- Increased payment security: The buyer’s bank guarantees payment once the seller fulfills the agreed-upon conditions;

- Reduced risk: Payment is linked to the fulfillment of specific conditions, such as proper documentation and delivery of goods;

- More financial flexibility: The L/C can serve as collateral with a bank, providing the seller with access to financing;

- Protection against currency risks: Payment is made in the currency of the L/C, insulating the seller from exchange rate fluctuations;

- Can serve as pre-financing: The L/C allows the seller to access funds before the goods or services are delivered;

- Enhanced confidentiality: Communications and documentation between banks and parties involved are often treated confidentially.

Benefits for Both Buyer and Seller:

- Strengthens trust internationally: the L/C provides a reliable payment guarantee, especially when dealing with new or unknown partners;

- Facilitates transactions even when the buyer’s creditworthiness is uncertain;

- Ensures compliance with terms: payment is contingent upon the correct submission of specific documentation, guaranteeing adherence to agreed-upon terms;

- Suitable for complex transactions: the L/C can effectively handle complex transactions with detailed payment terms and stages.

In conclusion, a Letter of Credit serves as a valuable tool not only for mitigating risks and ensuring secure transactions, but also for facilitating and promoting international trade.

“Berg Hortimotive uses L/Cs as an international payment method. Elceco’s team provides excellent support sharing their expertise advice and responding quickly and effectively to any questions we might have. We are extremely happy with their service.“

Berg Hortimotive about the collaboration with Elceco

The cons

Although Letters of Credit (L/C) offer many benefits in terms of payment security and risk management, there are also some disadvantages to using them:

- Complexity and administrative burden: preparing and processing the required documentation for a Letter of Credit can be complex and lead to a significant administrative burden for both buyer and seller. As a Letter of Credit specialist, we can help you with this. Read more about us or read what customers say about us;

- Documents in a Letter of Credit may contain errors, including:

-

- Errors: Typographical mistakes or incorrect formatting;

- Lack of clarity: Unclear instructions or ambiguous language;

- Difficulties fulfilling requirements: Seller’s inability to meet the stipulated conditions;

- Miscommunication between parties: Incorrect or incomplete instructions to third parties involved in the transaction.

-

- These errors can lead to delays in payments, increased costs, and even disputes. Therefore, it’s crucial for all parties involved to carefully review documentation and ensure clear communication throughout the process. This revision provides a more professional and informative presentation of the potential issues while maintaining clarity and avoiding negativity towards any specific party.

- Additional costs: the use of Letters of Credit entails costs, especially at banks, including issuing costs, documentary costs and any change costs;

- Potential delays: the process of document verification and approval may result in delays in payment, especially if there are problems or inconsistencies with the submitted documentation;

- L/Cs can be less flexible: making changes to the transaction terms after the L/C is issued can be complex and incur additional costs, potentially causing delays;

- Unconfirmed L/Cs carry credit risk: if the L/C is not confirmed by a second bank, payment remains dependent on the creditworthiness of the buyer’s bank, introducing an element of financial risk;

- L/Cs do not guarantee quality: while an L/C ensures the financial aspects of the transaction, it does not guarantee the quality of the goods or services provided. To mitigate this, you can request the inclusion of an inspection/quality certificate in the documentation, allowing an independent third party to verify the quality.

However, companies should carefully assess whether the L/C’s security benefits outweigh its drawbacks based on their specific business needs.

The involved parties

The following parties are involved in a Letter of Credit:

- Importer (as buyer); the importer is mainly located in regions such as the Middle East, Far East and Africa. The buyer initiates the L/C process by going to his bank with the request to open an L/C. The buyer undertakes to have the money from the transaction tied up with his bank, so that it is available to the seller;

- Exporter (as seller); the exporter must work with the buyer to agree on an L/C that is workable for both parties. This is usually a short summary of the sales contract in which the most important points are stated that must be carried out by the selling and/or purchasing party, depending on the L/C. The buyer and seller regularly agree on a draft L/C together before the buyer takes it to his bank. This often saves both parties a lot of time and money prior to the L/C process at the banks and possible issues are identified in a timely manner;

- The opening bank (on behalf of the importer); this is the buyer’s bank and the word basically says it all. They open an L/C in favor of the selling party, the exporter. They block the amount of the transaction from the purchasing party. They send a message to the selling party’s bank via SWIFT to take the process to the next step;

- The advising bank (on behalf of the exporter): this is the seller’s bank. They receive the SWIFT message from the opening bank and view the L/C from the financial point of view. They inform the seller by sending them the L/C, together with a preliminary letter in which they indicate additional aspects relating to the possibilities or possible risks of these transactions. Consider, for example, sanctions policy and money laundering.

“Over the years Meteor Systems have been completely satisfied with Elceco’s services.

Elceco liaises and thinks with us, gives good advice and is very approachable. Whoever you speak to, the service is always competent, efficient and helpful. We thoroughly recommend Elceco to any company in need of support with LC transactions.“

Meteor Systems about the collaboration with Elceco

Content

What does a Letter of Credit say? A Letter of Credit clearly states which product is delivered by whom, when and how the transport takes place. It also describes who bears what responsibilities.

Documents

A Letter of Credit is essentially a ‘documentary’ credit. This means that banks assess the transaction solely based on the presented documents. Whether the goods have actually been delivered correctly is irrelevant to the bank; the documents must perfectly match the terms in the L/C. The correctness of these documents is therefore the absolute condition for payment.

Below, we explain the most crucial documents and their specific points of attention.

- The commercial invoice:

- Purpose: this is the main financial document of the transaction. It specifies the goods sold, the price, the currency, and the delivery conditions (Incoterms). The goods description on the invoice must match the description stated in the L/C literally and exactly;

- Pitfalls: the most common error is a deviation in the goods description. Even a small variation, such as a different article number or a missing detail, will lead to rejection by the bank (a ‘discrepancy’). An incorrect L/C number or an invoice amount that is higher than the L/C allows are also critical errors;

- Elceco’s role: we check the draft invoice in detail against all L/C requirements. We ensure a 1-to-1 match and identify any potential deviation before the invoice is finalized. This prevents costly delays and rejections.

- The transport document (e.g., Bill of Lading or Airwaybill):

- Purpose: this document is proof that the goods have been handed over to the carrier for transport. A Bill of Lading (for sea freight) also represents ownership of the goods, making it an extremely important document;

- Pitfalls: errors in the name of the ‘shipper’ or ‘consignee’, mentioning an incorrect port of loading or port of discharge, or a shipping date that is later than allowed in the L/Concept. Another pitfall is an ‘unclean’ transport document, on which the carrier makes a notation about, for example, damaged packaging;

- Elceco’s role: we coordinate the transport details with your freight forwarder and meticulously check the draft transport document. We ensure all dates, ports, and goods descriptions are correct, so you receive a ‘clean’ document that will be accepted by the bank.

- The certificate of origin (CoO):

- Purpose: this document proves in which country the products were manufactured. It is often a requirement from customs in the buyer’s country, for example, to determine the correct import duty tariff;

- Pitfalls: the certificate is issued by an unauthorized party (it usually must be the Chamber of Commerce), the goods description is not identical to the one on the commercial invoice, the weight differs, or a required legalization by an embassy or consulate is missing;

- Elceco’s role: we know for each country and L/C which authority must issue the CoO and which specific requirements it must meet. We handle the correct application and coordinate any complex legalization processes. This ensures you have a valid and correct document.

In addition to these documents, a packing list, insurance certificate, or inspection certificate may also be required. The same rule applies to every document: 100% conformity with the L/C terms is the only way to a guaranteed and timely payment.

The handling

Processing a Letter of Credit involves several steps and the parties involved include the buyer, the seller, the opening bank (on behalf of the buyer), the advising bank (on behalf of the exporter) and sometimes the confirmation bank (optional). Below are the general steps when handling a Letter of Credit:

- Step 1: the importer goes to his bank to have a Letter of Credit drawn up in favor of the exporter;

- Step 2: the importer’s bank fixes an L/C amount (credit opening) under specific conditions;

- Step 3: the issuing bank then sends the Letter of Credit to the advising bank. The banks use the international means of communication SWIFT for this;

- Step 4: the exporter’s bank checks the Letter of Credit. If approved, he sends this to the exporter with an advisory letter. This completes the process at the bank;

- Step 5: the documents must meet the LC conditions in order to obtain an irrevocable commitment to payment;

- Step 6: if the conditions are met and approved by both banks, the payment by the exporter becomes final.

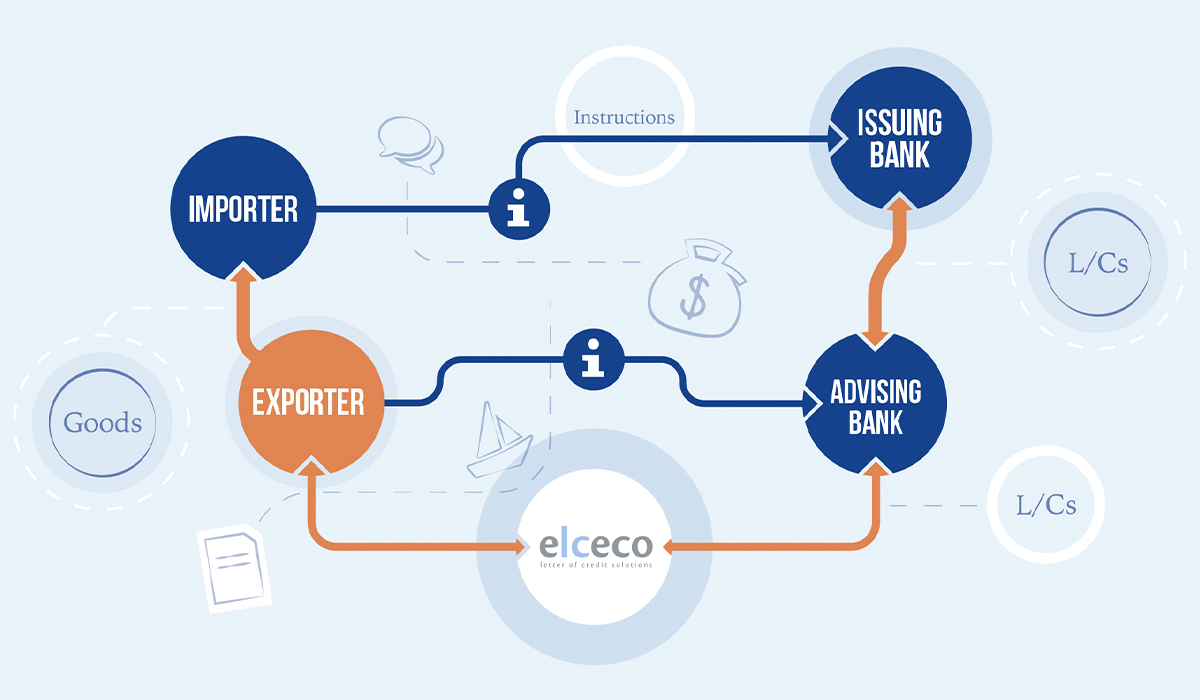

- Infographic

- The handling of a Letter of Credit is shown in an infographic below:

Letter of Credit in practice: pitfalls and solutions

A Letter of Credit offers a watertight guarantee, provided the process is completed flawlessly. In practice, however, this can be challenging.

The strict rules mean that a small deviation in the documents – a ‘discrepancy’ – is already enough for a bank to refuse payment. What happens if the delivery is delayed and conditions need to be changed via an ‘amendment’? These common challenges require specialist knowledge. Read more about this in our blog on common problems and solutions.

Costs

What does a Letter of Credit cost? The cost of a Letter of Credit depends on the following factors:

- The bank’s risk;

- The risk of the country to which the export is taking place;

- The amount of the Letter of Credit itself;

- The lead time of the Letter of Credit.

The alternatives

A Letter of Credit is an excellent instrument, but it is not the only solution for every transaction. Your choice depends on the relationship with your trading partner, the order size, and the risk you find acceptable. To help you make this decision, we have compared the L/C with the most common alternatives.

The history

The history of the use of Letters of Credit is significant and is characterized by the wide possibilities arising from internationally recognized rules and procedures.

The International Chamber of Commerce (ICC) played a pioneering role by establishing the first regulations in the early 1930s and combining them into the first Uniform Customs and Practice for Documentary Credits (UCP). Through this initiative, commercial banks created a voluntary framework to apply these rules in transactions worldwide.

In the early 1970s, SWIFT (Society for Worldwide Interbank Financial Telecommunication) was founded, allowing financial institutions to exchange data electronically and improving cost control. This international communication system between financial institutions provided an efficient way to facilitate transactions and contribute to the further development of international trade practices.

The common thread over the years has remained consistent: international business involving at least four parties, including the buyer, seller, opening bank and advising bank. Changes are especially visible in the receipt of Letters of Credit (L/C) and the processing and presentation of associated documents. In the beginning these were sent physically or via telex, nowadays this is done by e-mail, via integrated systems with the bank, and sometimes still in the classic way by post.

Thanks to advancing computerization, global communication is becoming faster and more efficient, allowing processes to run faster than before. Buyers and sellers can now communicate quickly via email or telephone, which has significantly increased the dynamics of international transactions.

FAQ

Frequently asked questions about the Letter of Credit (L/C):

The International Chamber of Commerce (ICC) played a pioneering role by establishing the first regulations in the early 1930s and combining them into the first Uniform Customs and Practice for Documentary Credits (UCP). Through this initiative, commercial banks created a voluntary framework to apply these rules in transactions worldwide.

In the early 1970s, SWIFT (Society for Worldwide Interbank Financial Telecommunication) was founded, allowing financial institutions to exchange data electronically and improving cost control. This international communication system between financial institutions provided an efficient way to facilitate transactions and contribute to the further development of international trade practices.

The common thread over the years has remained consistent: international business involving at least four parties, including the buyer, seller, opening bank and advising bank. Changes are especially visible in the receipt of Letters of Credit (L/C) and the processing and presentation of associated documents. In the beginning these were sent physically or via telex, nowadays this is done by e-mail, via integrated systems with the bank, and sometimes still in the classic way by post.

Thanks to advancing computerization, global communication is becoming faster and more efficient, allowing processes to run faster than before. Buyers and sellers can now communicate quickly via email or telephone, which has significantly increased the dynamics of international transactions.

The importer's bank fixes an L/C amount (credit opening) under specific conditions.

The issuing bank then sends the Letter of Credit to the advising bank. The banks use the international means of communication SWIFT for this.

The exporter's bank checks the Letter of Credit. If approved, he sends this to the exporter with an advisory letter. This completes the process at the bank.

The documents must meet the LC conditions in order to obtain an irrevocable commitment to payment.

If the conditions are met and approved by both banks, the payment by the exporter becomes final.

Contact with us

Do you have a question about our work or would you like more information about Letters of Credit? Fill in the contact form. Or contact us using the details below.

We think it is important to be easily accessible. Do you have any questions or doubts about something? Or do you just want to spar? Please feel free to contact us by telephone.

Telephone: +31 (0)413 353 131

E-mail address: info@elceco.com

We usually respond within two working days.

Address:

Hoogstraat 5

5462 CW Veghel

The Netherlands

Openings hours:

Monday to Friday from 08.30 to 17.00.

Closed on Saturday and Sunday.